Unleashing the Power of Citizen-Led Innovation in Financial Model Back-Testing

In today’s rapidly evolving financial landscape, the ability to adapt and innovate is crucial for success. This case study examines how a global financial institution transformed its forecasting model back-testing process through “employee-led” innovation. The initiative resulted in increased efficiency, reduced errors, and improved regulatory compliance.

The Challenge: Modernizing in a Highly Regulated Industry

The financial services industry has faced increasing scrutiny and regulatory pressure since the 2008 financial crisis, further intensified by the recent system-wide shock due to COVID-19. Regulators have become particularly sensitive to discrepancies between forecasting model outputs and actual financial performance. This global financial institution manages over 10,000 institutional clients, 100 million customers, and daily transactions exceeding USD 4 trillion. Given its scale, this regulatory environment posed significant challenges.

The institution’s legacy systems and manual processes, particularly in back-office operations, were ill-equipped to meet these new demands. While front-end systems directly impacting customer satisfaction had seen technological upgrades, back-office processes had been largely neglected. The existing model validation process was time-consuming, labor-intensive, and prone to errors.

In light of these mounting challenges, the institution recognized the need for significant change in its approach to regulatory compliance and operational efficiency.

The Catalyst: A New Vision for Adaptive Infrastructure

The appointment of a new CEO underscored the urgency of modernization, prompting a strategic focus on adaptive infrastructure. However, given the institution’s ongoing operations, a wholesale replacement of critical business processes was not feasible. Additionally, the institution was already engaged in a long-standing initiative to address requests from the Federal Reserve Board (FRB) and Office of the Comptroller of Currency (OCC).

The Solution: Harnessing Employee-Led Innovation

In response to these challenges, the institution embarked on a strategic initiative to foster “employee-led” solutions for key business objectives. This approach recognized that employees, who constantly seeking ways to automate their work, could serve as a valuable source of innovation.

By semi-formalizing the most promising efforts, management aimed to solve immediate operational challenges while also cultivating a culture of innovation and adaptability. This approach promised to address regulatory requirements while simultaneously improving efficiency and accuracy in critical back-office processes.

The success of this employee-led innovation initiative relied heavily on the contributions of personnel with specific skill sets.

Why I was able to step in

My skill set made me an ideal person to help with this endeavor. I brought methodical problem-solving abilities, effective communication, leadership, and financial management expertise. These skills were complemented by my hands-on involvement in digital initiatives.

The Actions

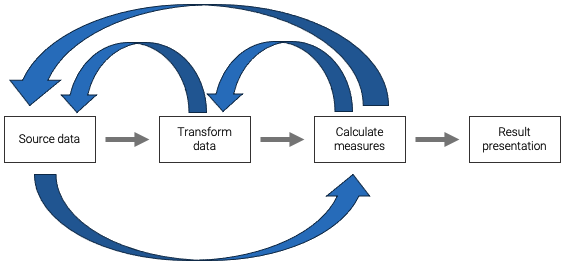

Leveraging my skills, along with those of a database administrator and Tableau expert, the initiative followed a structured methodology centered on Robotic Process Automation (RPA). This approach guided the entire process, from defining the use cases to deployment and project closure.

The Results

The initiative created an automated solution that could be scaled. It significantly reduced manual work and increased accuracy. The project eliminated over 1,100 hours of manual work annually, leading to improved risk management and making the institution more efficient overall.

The impact of these improvements extended beyond operational metrics, gaining recognition at the highest levels of the organization. In his quarterly newsletter, the Sector’s Chief Financial Officer publicly praised the project’s value.