In any high stakes venture it is vital, whether for yourself or a client, to have a sustainable edge.

In any high stakes venture it is vital, whether for yourself or a client, to have a sustainable edge.

Warren Buffet calls it a Durable Competitive Advantage and Michael Porter refers to it as a Competitive Advantage. Regardless of the phrasing, the concept is the same. Never move into, or stay in, a space where you don’t have a major advantage over others.

One of the best ways to insure that this doesn’t afflict you is to deliver radically new (unique) value to your customers. And, one of the strongest frameworks to identify and exploit your unique advantage(s) is business model innovation.

In Business [Re]Ignition: The 7 Rock Solid Elements of Executing Business Model Innovation (The Intro) I laid out my thoughts on why this works and introduced the seven elements that need to be included in the process. The complete package is built upon the thinking of not only the authors mentioned above but that of Alexander Osterwalder, Steven Blank, and Tim Kastelle to name a few.

Over the next several weeks we will be walking through the elements looking at why they are in place, the value they add to our journey, and most importantly how we execute against them.

First up is Benchmarking.

I can almost hear the process purist clamoring… ‘Why should we start with something that’s usually relegated to the backend?’ Here’s why I suggest you start dealing with it day one.

It’s Not Easy

Can organizations measure the impact of their innovations? See how they stack up against their peers? And, track the long-term effects of their choices? Absolutely yes, on all counts. And, you need to do this.

But, it is one of the hardest things to do in the entire process.

Here are two characteristics that make measuring innovation so complex:

- Business model adjustments can have impacts on both society and the environment – both positive and negative – but translating them in to a comparative measure is highly subjective.

- Business model innovation is not a one-off event but a process, it’s on-going. Thus of the three core approaches used to value a business decision – asset based, market comparison, and earning value – only one, earning value, has a shot and even that has it caveats.

Question: But Again, Why Now?

Here’s what I’ll do, let’s refer to it as formulating our original reference point. We need to get to the truth about where you’re currently at and the direction it’s talking you.

And, determining how to construct that stake in the ground is the objective of this post.

One of the first things that is ingrained into you (some would say beaten) during Finance 101, heck most likely all of business school, is that one cannot make a solid decision without a good understanding of what’s at risk with each of the presented opportunities. It’s all relative. Thus the most likely option, ‘business as usual’ is the ideal reference point.

Additionally, here is another rationale that could have been included above. People, all people, are to some extent revisionist. When we look back our lessons learned during the duration tend to color our opinion of our past situation. When benchmarking we want to be sure that it is a comparison of what we did versus the course our ‘then’ decisions would of led us down.

Even when developing this reference point in the moment one has to be careful of not being overly optimistic. There is a reason an organization has been brought to the point of contemplating a restructuring of their business model. Whether it is the fact that the business isn’t living up to it’s profit potential or an external force like a macro-economic spasm or key trend shift the future isn’t rosy so don’t model it as it is.

Tim Kastelle penned a very good post, Lessons From Kodak’s S-Curve Problems, that touched on this snare. And, here is the key takeaway.

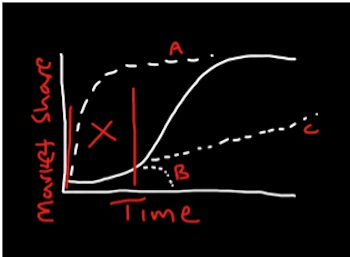

“There are no straight lines in business. If you ever find yourself making a projection like Curve C, you are almost certainly wrong. Be cautious of this, especially if this projection suggests that you have a long time to respond to changes.”

So what is the right curve? Take a look at B. It certainly seems to represent a business that’s struggling to make the numbers, losing market attention, and just plain stuck.

How: Best Metric

As I alluded to above measuring innovation isn’t easy.

The academic studies are ongoing and much needed, but as a business practitioner you’re looking to see if the result is better than the start. And, that is exactly the right perspective to have.

So what should we use?

Profitability, or to be more precise cash flow since profit doesn’t equal cash flow because of the influence of accounting rules on the recognition of revenue and expenses. Cash flows estimates that are then used to determine the net present value (NPV) of the BAU scenario.

Some would object to this selection stating that it would be biased against the post execution metric since major profits typically come late in the innovation cycle thus it lags the initial innovation by a significant period. This is true, however, what we ultimately want to determine/measure is an investment decision. Are/were the time-delayed cash streams, with the new risk profile (risk coefficient) more valuable than those of the initial state? With regards to timing, it is always a factor in every business decision.

For every business there are secondary measures that need to be captured, it’s just that the mix will vary by business type. For example, if you are a physical retailer you might look at things like average sale per visit or visitation frequency. While online businesses might look at referrals, app downloads, or revenue per subscriber month.

Benchmarking is never simple

Not in the least, but it is one of the most important things that you will do. So, here are some tips to help you be successful.

- Base the decision on your business’ needs

- Select measurement techniques that translate across paradigms

- And, objectively evaluate what your current business is worth

That very much is the point. The ultimate goal of innovation is to transform ideas into a significant boost in the business’ value. Without knowing from where you came you have no hope of determining if you’re headed toward a better place.

If you have anything to add to the conversation please chime in below; be blunt but not cruel.

In the next part we will explore Discovery. See you next Monday.